Quick Hits - Canadian R&D Spending, Keeping Pace with Tech Change, and De-risking Supply Chains

A quick summary of some interesting reads

In today’s newsletter, I look at the recent data on higher education R&D spending in Canada, turn to the US and commentary on eroding state and regulatory capacity at a time of immense technological change, before talking about another major tend and its impact on Canada - the derisking of global supply chains. I hope you enjoy it!

R&D Spending in Canada’s Higher Education Sector

Statistics Canada has just released data on spending on research and development in the higher education sector over 2022/2023.

Spending reached $18.1 billion, up $1.4 billion over the previous year, with $13.6 billion going towards natural sciences and engineering research.

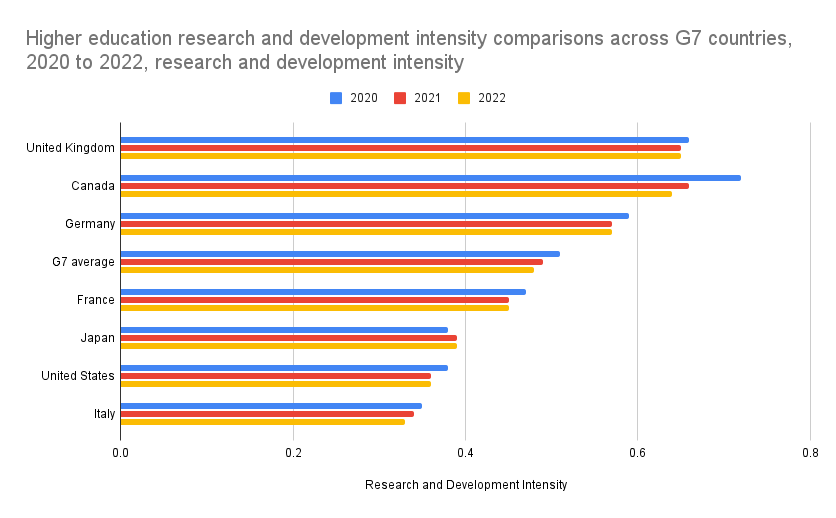

The scale of spending in higher education puts Canada close to the top of the G7 - though with a gradually declining R&D intensity:

Unfortunately, the scale of spending in HE does not make up for the weak levels of business R&D spending. This is last year’s data but illustrates how far back Canada is in overall spending:

While fundamental research is essential, and there is an important role for investigator-instigated research to open new scientific frontiers, it is clear that this alone does not yield economic and societal gains for Canada. Ultimately, it is R&D spending outside of HE, by governments and businesses, that does this, especially when accompanied by innovation-enabling policies in regulation, procurement, competition etc. Boosting those other types of R&D spending, and focusing more on wider structural policies, are our chief challenges in unlocking Canada’s innovative potential.

The Race between Regulators and Technology

The pace of technological change cannot be overstated. Nor can the fact that state institutions, after decades of assault and hollowing out, are struggling to keep up. Nowhere are both parts of this more true than in the United States, as this piece from Tom Wheeler for Brookings looks into.

Wheeler examines how recent Supreme Court decisions have constrained various federal agencies’ ability to protect the “public interest” or meet national security obligations through regulation. These rulings have served to “substitute the judgment of non-expert judges for that of expert agencies created by Congress”.

In Wheeler’s view, the effect of this is to pass rule-making into the hands of AI companies and their investors without public oversight.

While Canada’s regulators have not been hobbled in the way those in the US have, what happens south of the border will still have massive ramifications here. The ability of US companies to develop technology with potentially huge negative impacts (as well as the potential for major positives) with limited public guardrails will have spillovers globally.

All of this is at a time when Canada’s approach to AI regulation, two years in the making, remains in limbo and might not be passed before the next election. If that is the case then it might well be back to the drawing board and another two years before new regulatory powers around AI are in place. While we might still be a long way from artificial general intelligence by then, we can still be sure that we will have even more powerful models and it will be even harder to constrain negative impacts.

De-Risking Supply Chains in a Changing World

If rapid technological change is one major global trend impacting Canada, another is the move towards de-risking global supply chains. The COVID-19 pandemic highlighted the fragility of just-in-time supply chains and the need for more reliable sources of critical goods. But the threats to supply chains go far beyond just pandemics, with climate change already wreaking havoc and heightened geopolitical tensions revealing critical national security risks. These concerns have been accompanied by a desire in advanced countries to rebuild manufacturing bases eroded by decades of laissez-faire trade policies.

We can see this playing out in Canada most obviously with EVs, with billions committed to building electric vehicle and battery factories, along with investment in the critical minerals sector. These efforts have been paired with 100% tariffs on Chinese EVs - designed to protect jobs in the nascent EV industry, counter Chinese dominance of the sector, accelerate decoupling from China and keep Canada aligned with the US.

Whether these are good policies or not is very much a matter of debate. They do, however, speak to the complex picture of supply chains right now. This recent research paper from the Hinrich Foundation goes into depth to examine what is happening and how it is important to look beyond just material flows and explore changes to information, financial, and human flows as well.

The paper’s authors, Tinglong Dai and Christopher S. Tang, argue that “global supply chains are undergoing an irrevocable shift”, representing “a fundamental reorganization, not just a logistical tweak, of the global supply chain landscape, one that will reshape the terrain for generations to come”. This is a trend that will have major implications for Canada and has the potential to feed into an ever-greater dependence on US markets. How federal and provincial governments respond will have impacts for a long time.